|

|

|

#11 |

|

Senior Member

Join Date: Jan 2006

Location: NOVA

Posts: 3,005

|

Uh...since taxes are a % of your income, if you make more you'll pay more. Not that complicated.

__________________

太初有道 |

|

|

|

|

|

#12 |

|

Senior Member

Join Date: Jan 2006

Location: NOVA

Posts: 3,005

|

Oh gee, I wonder why the top 1% are paying a greater share in taxes?

Could it be they are making a greater share?

__________________

太初有道 |

|

|

|

|

|

#13 | |||||

|

Senior Member

Join Date: Dec 2006

Posts: 8,596

|

Quote:

I'm no economist, but I'm a decent Googler, so I drummed up a few stats. This 2002 study on middle-income tax burden finds: Quote:

Quote:

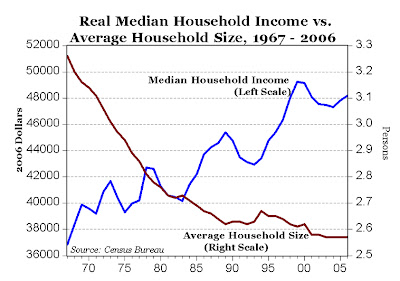

Then, of course, it's important to consider income as a function of demographic, as this Wall Street Journal article does. For example, while acknowledging that as a percentage of GDP the portion consumed by the poor has shrunk .7% over 35 years, yet: Quote:

He then quotes one economist who observes: Quote:

All of this, of course, distracts from the original issue, which is how much of the tax burden is shouldered by so few. RedHeadGirl cites "much is given", as though those paying taxes are "given" what they earn. What nonsense. Here's a better graph illustrating the problem:  Just under half of all tax "payers" actually pay taxes--and they pay almost ALL of them. The bottom 50% pay next to nothing. This is part of the reason why they don't get tax cuts. Because they don't pay them! Next time someone whines about how the top 10% get all the tax benefits, I'm going to show them this graph.

__________________

"Have we been commanded not to call a prophet an insular racist? Link?" "And yes, [2010] is a very good year to be a Democrat. Perhaps the best year in decades ..." - Cali Coug "Oh dear, granny, what a long tail our puss has got." - Brigham Young Last edited by Tex; 08-05-2009 at 03:11 AM. |

|||||

|

|

|

|

|

#14 | ||||

|

Senior Member

Join Date: Jan 2006

Location: NOVA

Posts: 3,005

|

Quote:

Quote:

36% in 40 years? Let's do a little algebra: 1.36 = 1(1+g)^40 that's less than 1% growth every year. Wow! The poor's not doing so bad after all. They should so pay more of their share in taxes. Quote:

Quote:

__________________

太初有道 |

||||

|

|

|

|

|

#15 | |

|

Senior Member

Join Date: Dec 2006

Posts: 8,596

|

Quote:

Regards.

__________________

"Have we been commanded not to call a prophet an insular racist? Link?" "And yes, [2010] is a very good year to be a Democrat. Perhaps the best year in decades ..." - Cali Coug "Oh dear, granny, what a long tail our puss has got." - Brigham Young |

|

|

|

|

|

|

#16 |

|

Senior Member

Join Date: Jan 2006

Location: NOVA

Posts: 3,005

|

That part was TIC, the rest of my post was serious.

__________________

太初有道 |

|

|

|

|

| Bookmarks |

|

|